The Duty of Offshore Investment in Estate Planning and Wide Range Preservation

The Duty of Offshore Investment in Estate Planning and Wide Range Preservation

Blog Article

Just How Offshore Financial Investment Works: A Step-by-Step Malfunction for Investors

Offshore financial investment presents a structured pathway for capitalists looking for to optimize their economic approaches while leveraging international chances. The process starts with the careful option of a territory that lines up with a capitalist's goals, followed by the establishment of an account with a trustworthy overseas organization.

Comprehending Offshore Investment

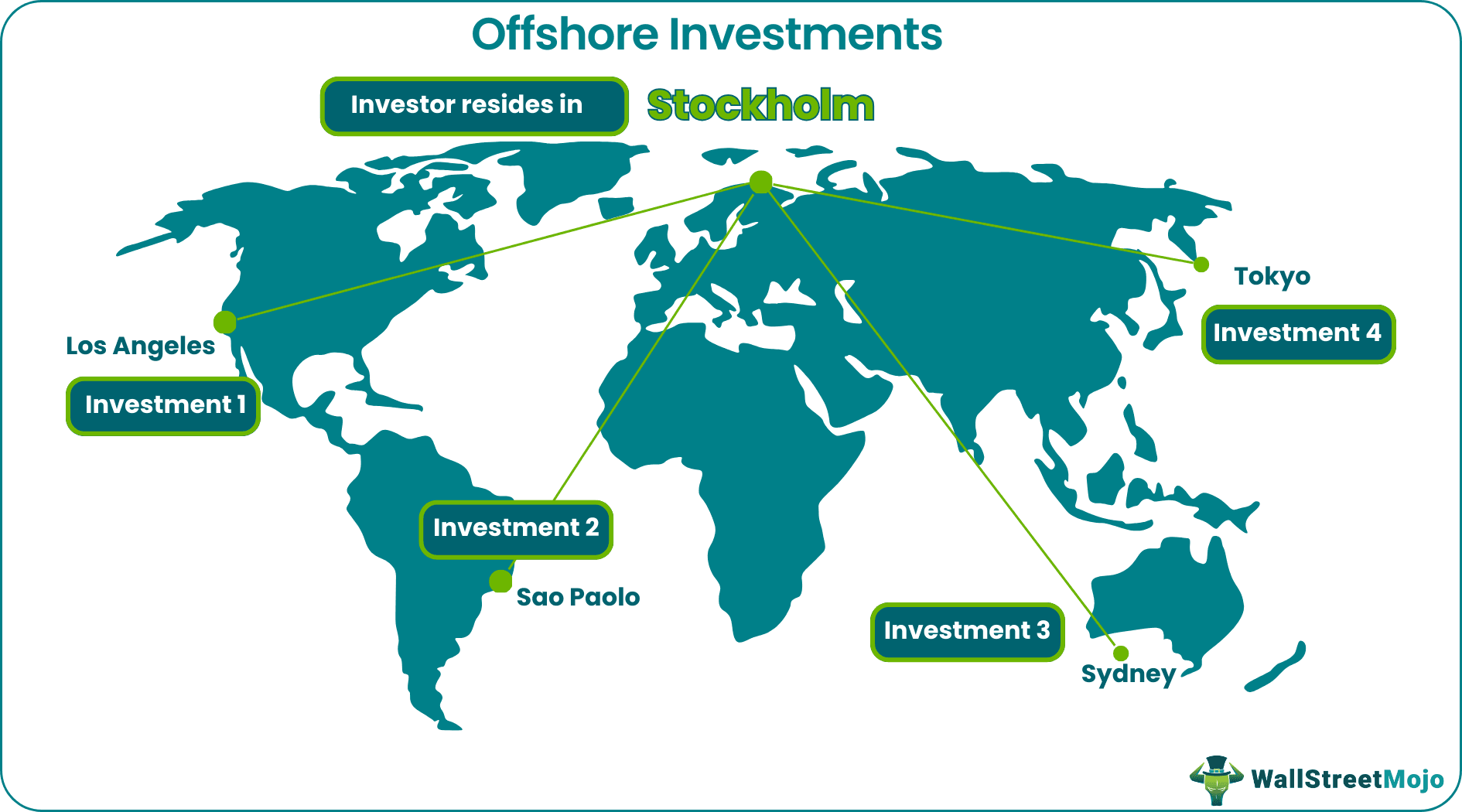

Recognizing overseas investment entails acknowledging the tactical benefits it supplies to individuals and firms looking for to enhance their financial profiles. Offshore investments commonly describe possessions kept in a foreign territory, typically identified by beneficial tax obligation routines, regulatory atmospheres, and privacy defenses. The primary intent behind such investments is to improve resources diversity, threat, and growth management.

Capitalists can access a wide range of monetary tools via overseas places, including stocks, bonds, mutual funds, and realty. These financial investments are usually structured to adhere to local laws while providing versatility in terms of possession appropriation. In addition, overseas financial investment strategies can allow individuals and services to hedge against residential market volatility and geopolitical threats.

An additional secret element of overseas financial investment is the potential for boosted privacy. A comprehensive understanding of both the commitments and benefits associated with overseas financial investments is important for educated decision-making.

Advantages of Offshore Investing

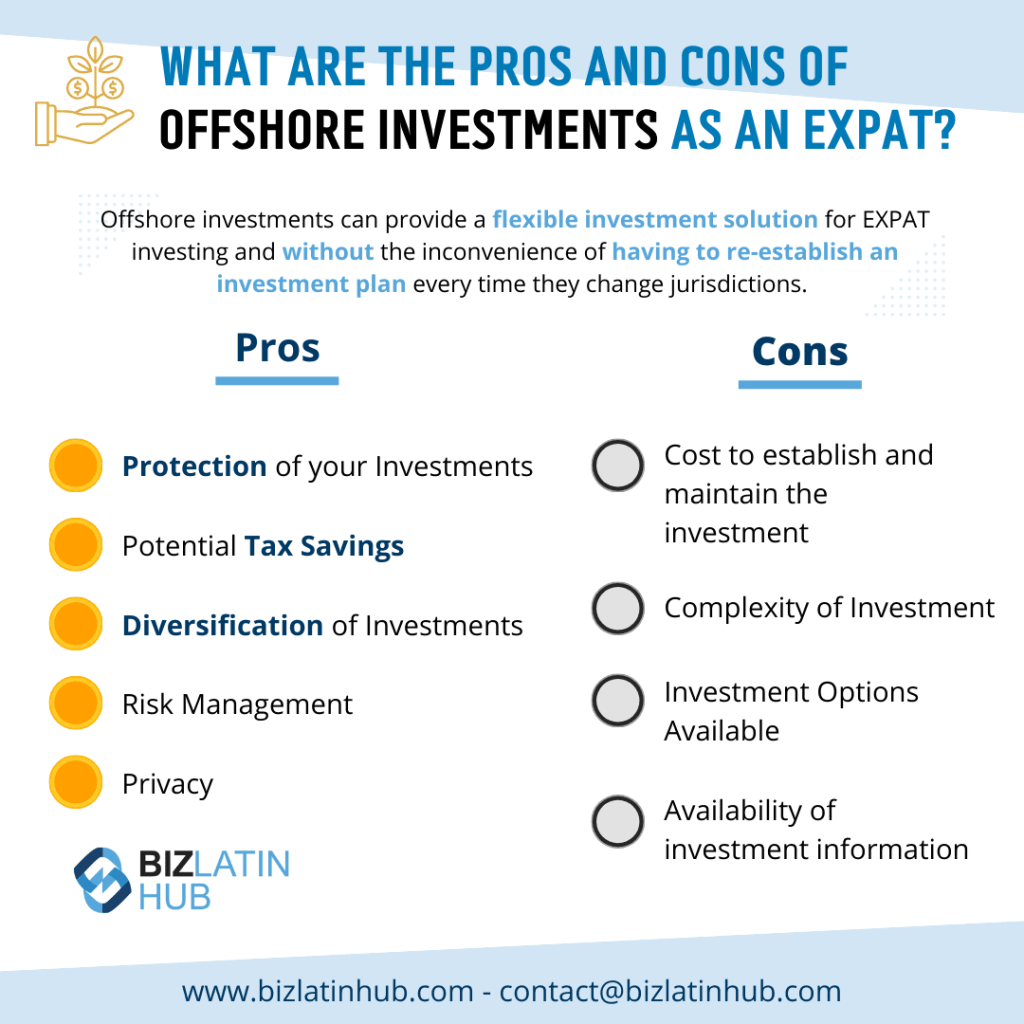

Financiers frequently transform to offshore investing for its many advantages, consisting of tax effectiveness, property protection, and portfolio diversity. One of the main advantages is the potential for tax optimization. Lots of overseas jurisdictions supply beneficial tax obligation regimes, enabling capitalists to legally decrease their tax obligations and maximize returns on their financial investments.

Additionally, overseas accounts can give a layer of asset security. Offshore Investment. By putting properties in politically secure territories with strong personal privacy regulations, investors can secure their wide range from possible legal claims, lenders, or economic instability in their home countries. This form of security is particularly appealing to high-net-worth people and business owners facing lawsuits dangers

Furthermore, offshore investing helps with portfolio diversity. Accessing global markets enables capitalists to check out opportunities in different possession classes, consisting of actual estate, supplies, and bonds, which might not be available domestically. This diversification can lower total profile risk and enhance prospective returns.

Eventually, the advantages of overseas investing are engaging for those looking for to maximize their financial strategies. However, it is critical for financiers to completely understand the policies and implications related to offshore investments to make sure compliance and attain their monetary goals.

Choosing the Right Jurisdiction

Picking the suitable territory for overseas investing is an essential decision that can dramatically impact a capitalist's financial method. The ideal jurisdiction can supply various benefits, consisting of beneficial tax obligation frameworks, asset protection legislations, and governing environments that align with a financier's objectives.

When selecting a jurisdiction, take into consideration factors such as the political stability and financial wellness of the country, as these elements can influence investment safety and security and returns. Furthermore, the legal structure bordering international financial investments must be evaluated to make certain compliance and security of properties. Countries understood for durable lawful systems and transparency, like Singapore or Switzerland, commonly instill higher self-confidence among financiers.

Furthermore, examine the tax obligation ramifications of the jurisdiction. Some countries provide appealing tax motivations, while others may impose stringent coverage needs. Understanding these nuances can help in optimizing tax liabilities.

Steps to Establish Up an Offshore Account

Developing an offshore account entails a series of systematic steps that ensure conformity and safety. The primary step is choosing a why not try these out respectable offshore monetary establishment, which ought to be accredited and regulated in its territory. Conduct thorough research study to analyze the organization's credibility, services supplied, and customer reviews.

Following, collect the necessary documents, which usually includes recognition, evidence of address, and information pertaining to the resource of funds. Different territories might have varying requirements, so it is essential to confirm what is needed.

As soon as the documentation is prepared, initiate the application process. This might involve completing forms on the internet or in individual, More about the author depending on the organization's methods. Be planned for a due persistance procedure where the financial institution will confirm your identification and assess any kind of possible threats related to your account.

After authorization, you will receive your account details, permitting you to money your offshore account. It is a good idea to maintain clear records of all transactions and comply with you could try this out tax obligation guidelines in your house nation. Developing the account properly sets the foundation for effective offshore investment management in the future.

Managing and Monitoring Your Investments

Once an offshore account is successfully established up, the emphasis changes to handling and monitoring your investments effectively. This crucial phase involves an organized strategy to guarantee your possessions line up with your financial goals and run the risk of tolerance.

Begin by establishing a clear investment technique that outlines your goals, whether they are capital preservation, revenue generation, or development. On a regular basis examine your portfolio's efficiency versus these benchmarks to analyze whether adjustments are required. Utilizing economic administration devices and systems can promote real-time monitoring of your investments, giving understandings into market fads and possession allowance.

Engaging with your overseas monetary advisor is crucial. They can provide proficiency and advice, assisting you browse complicated regulative environments and international markets. Set up routine evaluations to review efficiency, analyze market conditions, and alter your technique as necessary.

Furthermore, remain notified concerning geopolitical developments and financial signs that might affect your investments. This aggressive method enables you to respond promptly to altering conditions, ensuring your overseas profile continues to be durable and straightened with your financial investment goals. Inevitably, persistent management and recurring tracking are vital for making best use of the advantages of your offshore financial investment strategy.

Conclusion

In conclusion, offshore investment provides a calculated opportunity for profile diversification and threat management. Continued tracking and cooperation with financial consultants continue to be important for preserving an active financial investment method in an ever-evolving international landscape.

Offshore financial investment offers an organized path for financiers looking for to maximize their financial techniques while leveraging worldwide opportunities.Understanding offshore financial investment entails recognizing the strategic advantages it supplies to people and firms seeking to enhance their financial portfolios. Offshore financial investments typically refer to assets held in an international territory, commonly defined by favorable tax programs, regulative atmospheres, and personal privacy securities. Additionally, overseas financial investment approaches can make it possible for organizations and people to hedge versus residential market volatility and geopolitical threats.

Report this page